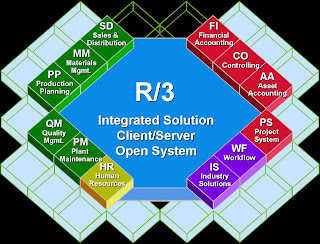

- FI is concerned with accounting for what a company buys, sells, owes, and owns

- FI is the cohesive force, or backbone, that ties together all other modules

- All other modules integrate in some way with FI, and it requires cross-functional processing

- Options within the configuration set-up of SAP provide FI with a lot of flexibility

Financial Accounting is primarily concerned with:

•General Ledger Accounting

•Financial Reporting

•Processing of financial data from other modules with which it is integrated

•Accounts Payable

•Accounts Receivable

FI Terms in SAP (vs. Industry)

Posting Peroid = Accounting Period

Incoming Payment = Cash Allocation

Cross-Company Transaction = Inter-company Posting

Vendor = Supplier

Document = Voucher/Journal

FI Concepts

- FI is used in the process of accounting for money moving into and out of the company

- FI provides and supports external reporting requirements (e.g., legal, shareholders, government)

- FI’s primary goal is producing the financial statements for the company (e.g., balance sheet, income statement)

Financial Accounting is concerned with:

- What is bought, sold, owed, and owned

- The inflow and outflow of funds, as well as the net result of those flows

Financial Accounting does not keep records of:

- Where money is spent (e.g., to which cost center or work order)

General Ledger Accounting

- Used to record the business activities of a company

- Used to identify the “what” aspect of financial accounting (e.g., salary expense, buildings, sales revenue, etc.)

- Each account represents a unique type of business event, obligation , or asset

- Each account in SAP is represented by a number (e.g., salary expense = 500,000)

- In SAP the assignment of General Ledger account numbers follows a logical structure

•In order to distinguish between the various FI documents, document types are used. Each document is assigned to one document type, and this is entered in the document header. Document numbers are provided by the document number ranges assigned to one or more document types.

•For G/L account postings, document type SA is used, although other document types are possible (such as accrual/deferral documents, valuation documents, and so on).

For each company code, you have to specify one General Ledger Accounting for the general ledger. This General Ledger Accounting is assigned to the company code. A General Ledger Accounting can be used by multiple company codes (Chart of accounts -> Company code is one-to-many relationship). This means that the general ledgers of these company codes have the identical structure.

General Ledger Book (Chart of Accounts)

- Called the Chart of Accounts in SAP

- Is the official list of all the General Ledger accounts

- Supports the legal reporting and record keeping requirements of the company

- Is independently auditable

- Is used as the basis for producing Financial Statements

Organizational Data

- Company Code

- Chart of Accounts

- Fiscal Year Variant

- Credit Control Area

- Business Area & Functional Area

Company Code

- An Organizational unit in SAP that normally represents a legal entity

- May also be based on external reporting requirements (e.g., a utility company may be one legal entity for tax purposes but must also provide reports to support regulatory statutes, dictating that more than one Company Code may be set up)

- Level at which Financial Statements are created in FI (several Company Codes can be consolidated)

- May be one or more per Client

Chart of Accounts- List of all General Ledger accounts that may be used by a Company Code

- May be one or more per Client

-- Statutory reasons may dictate more than one is necessary (e.g., Belgium determines the account numbers a company must use for reporting, these will usually not match current numbering logic used by the rest of the corporation)

- Each Company Code must be assigned to a Chart of Accounts

- A single Chart of Accounts can be shared by various Company Codes

Fiscal Year Variant

- Defines the number of posting periods allowed in one fiscal year

- Allows the definition of a fiscal year that is different from a calendar year (i.e., a fiscal year which runs from April 1st through March 30th)

Credit Control Area- Credit is managed in SAP within Credit Control Areas. Once set, individual credit details are managed at the customer master level through the Credit Management function

- The following parameters are set at the customer master record level:

-- Total: Maximum credit for a Customer across all Credit Control Areas

-- Maximum Per Credit Control Area: Maximum credit limit for any one Credit Control Area

-- Credit Limit: Amount of credit extended to a Customer at this point in time. It cannot exceed the Maximum Per Credit Control Area

Business Area

- Business areas represent separate areas of operation within an organization

- Can be used across company codes.

- They are balancing entities which are able to create their own set of financial statements for internal purposes.

- The use of business areas is optional.

Master Data

G/L Accounts

Account Groups

Transactional Data

- Document Types and Number Ranges

- Posting Periods

- Financial Tolerance Groups

- Taxes

- Financial Posting/Document Entry

Document Types and Number Ranges

- Document Types: Classifies accounting documents (e.g., Inventory Document, G/L Account Posting) as to their purpose. SA is the standard G/L Document Type

- Document Number Ranges: Each Document Type is assigned to a specific Number Range within the entire range available in SAP

- Both Document Types and Number Ranges enable organization of documents and permit easy recognition on reports and displays

Posting Periods

- Periods opened/closed via simple table changes to enable/disable posting for a particular month

- Can open/close periods by G/L Account or Account Type (e.g., payables can close before G/L)

- Posting in the current month is usually carried forward a few days into the new month to allow for month-end processing

- Special periods are available for year-end adjustments as an option to re-opening closes periods

- Adjustments made to prior year will automatically revise the opening balance of the current fiscal year as reflected on the balance sheet

Financial Processes

Define Tolerances for Groups of SAP Users

- Prescribe maximum dollar amount a user can post in an FI document (e.g., sum of all debits or credits)

-- A different dollar amount can be specified for Customer/Vendor Accounts and G/L postings

-- Maximum allowable cash discounts may also be set for tolerance groups

- Define permitted payment differences on vendor and customer invoices

Taxes

- Tax Categories

-- Identified on the G/L master record, they specify to the system whether the account is pertinent to Input or Output taxes

--- Input taxes are taxes which the company pays on purchases

--- Output taxes are taxes which the company pays on purchases customers on behalf of the tax authorities

- Tax Codes

-- Two-digit code that represents the specifications used for calculating and displaying tax

-- Configured in the IMG, tax codes identify the breakdown of the Input or Output tax

-- Identified on the G/L document at the time of posting, based on the Tax Category of the G/L account

- Tax Codes, continued

-- Examples of tax codes might include l1, l2, O1, O2, etc.

--- Examples of tax breakdown might include 7% PST/7% GST, 0% PST/7% GST, etc.

- Automatic Tax Posting

-- The process by which SAP automatically determines the tax amount and the correct G/L account to post taxes to

-- Via an IMG process, the correct G/L accounts are identified, and tax line items are automatically generated based on the tax code entered on the document

Financial Posting / Document Entry

- Often called a Journal Entry or FI Posting

- Posting is a financial entry to a General Ledger account

- Each posting produces a Financial Document

- All postings must be balanced where debit and credit dollar amounts are equal

- SAP financial documents consist of:

-- Header: Posting Date, Company code, Currency, Document Type, User ID

-- Line Items: Post Key, G/L Account Number, Amount, Quantity

- Every financial document has an associated Document Type and a Document Number

- The posting key (PK) has a control function pertaining to the document line items.

- It determines the following:

-- Account type for the posting of the line item

-- Posting of line items as debit or credit postings

-- Field status of additional information

Analyzing Account Data

The following tools are available to aid in account analysis:

- Account balance Display

- Line items: Open, cleared, special G/L

- Selection criteria (allows the user to narrowly define search criteria)

- Line layouts: Customize display of line item details (columns)

- The drill down feature allows users to quickly navigate from high level view to source item view by double clicking on each item

Account Payable & Account Receivable Concepts- Sub-Ledgers are the individual master records unique to each customer and vendor, where the details of all transactions are recorded

- The financial data recorded in each sub-ledger is summarized in the general ledger, in an account called a Reconciliation Account

-- A/P: Summarizes the amounts owed to vendors

-- A/R: Summarizes the amounts due from customers

- Posting:

-- Reconciliation Accounts are updated internally each time the sub-ledger is posted to, by way of the Three-Way Posting

-- All direct postings (i.e., invoice entry) are done directly at the sub-ledger level

Master Data

- Is static data which represents things, rather than events (which would be transaction data)

- Is input to SAP transactions

- Is a central repository shared across SAP modules

- Customjer Master Records

- Vendor Master Records

Transaction Data

- Is dynamic data, meaning that it is typically changed or created many times in one day

- Records a business activity or event

- Invoice Entry

FI Transactions Overview- FI Documents are generated through one of three methods:

-- Manual entries executed from within the module itself

-- The effect of other SAP processes outside of FI which automatically generate financial postings

--- Usually includes “automatic account assignment”

--External, non-SAP systems interfaces

-In all cases the system automatically generates an FI document with its own unique number

Wow.. Thanks much for sharing.. My friend also recommended you so that i can have a helping hand to make my blog as effective as possible.

ReplyDeleteSAP Training in Chennai

SAP FICO Training in Chennai

SAP ABAP Training in Chennai